Astha

Child Care

This is the best plan for one’s child’s education. It contains attractive benefits which can secure every stage of any child’s growth. In case of sudden demise of parent, the child will get full Sum Assured and the flow of cash will be availed by the child as a form of Stipend till the end of the term of policy. Before the end of the term if the insured child expires (after the death of the Policy Holder) the stipend facility will be stopped.

Feature & Benefit

Payor may be -

- father,

- mother or

- any legal guardian of the Child.

When you purchase a life insurance policy, you agree to pay a specific sum of money, known as the premium, to the insurance provider at regular intervals. The frequency or period of your payments depends on your chosen mode of premium. AsthaLife offers several modes of premium payment for the product, including:

- Annual: You pay the premium once a year.

- Semi-annual: Payments occur every six months.

- Quarterly: You make payments every three months.

- Monthly: You pay the premium once a month.

In that case the calculations are as follows: --

- Half yearly premium = Annual premium x 0.51

- Quarterly premium = Annual premium x 0.26

- Monthly premium = Annual premium x 0.09

When you purchase a life insurance policy, you agree to pay a specific sum of money, known as the premium, to the insurance provider at regular intervals. The frequency or period of your payments depends on your chosen mode of premium. AsthaLife offers several medium of premium payment, including:

Bank: Premium payments can be made through your bank account. You can use net banking, mobile banking, or visit the bank in person to initiate the payment. AsthaLife has tie-ups with specific banks for seamless transactions.

Cheque: Write a cheque for the premium amount and submit it to the insurer. Ensure that the cheque is correctly filled out, signed, and dated. AsthaLife will process the payment upon clearance.

Mobile Banking: Use mobile banking apps to transfer the premium amount directly from your bank account to the AsthaLife. This method provides convenience and real-time confirmation.

Electronic Funds Transfer (EFT): EFT allows you to authorize automatic premium deductions from your bank account. Set up an EFT mandate with AsthaLfie, and the premium will be debited on the specified dates.

Child Age

- The entry age of a child is minimum 03 months to maximum 15 years.

- The maximum age of the child at maturity would be 25 years.

Payor Age

- The entry age of payor is minimum 20 to maximum 60 years.

- The maximum age of the payor at maturity would be 70 years.

Minimum term is 10 years and Maximum term is 25 years.

Supplemental life insurance is an additional layer of coverage that you can purchase alongside your existing life insurance policy. These riders can be added to your primary life insurance policy for added security and can enhance your overall protection.

- Health Insurance (HI): Unforeseen medical expenses and other living costs can arise unexpectedly, often at the most inconvenient times. AsthaLife's supplemental health plans provide cash benefits to assist you in covering various everyday expenses, offering a sense of security and peace of mind.

- Critical Illness (CI-8): Critical illness insurance is a form of supplemental insurance that provides coverage for expenses not typically covered by your standard health plan. Its purpose is to create a monetary safety net in case you face a medical diagnosis that could result in expensive treatments or other financial hardships.

- Death claims are exempt from income tax.

- 5% tax is applicable at source on the excess of insurance claim amount excluding gross accumulated premium on maturity.

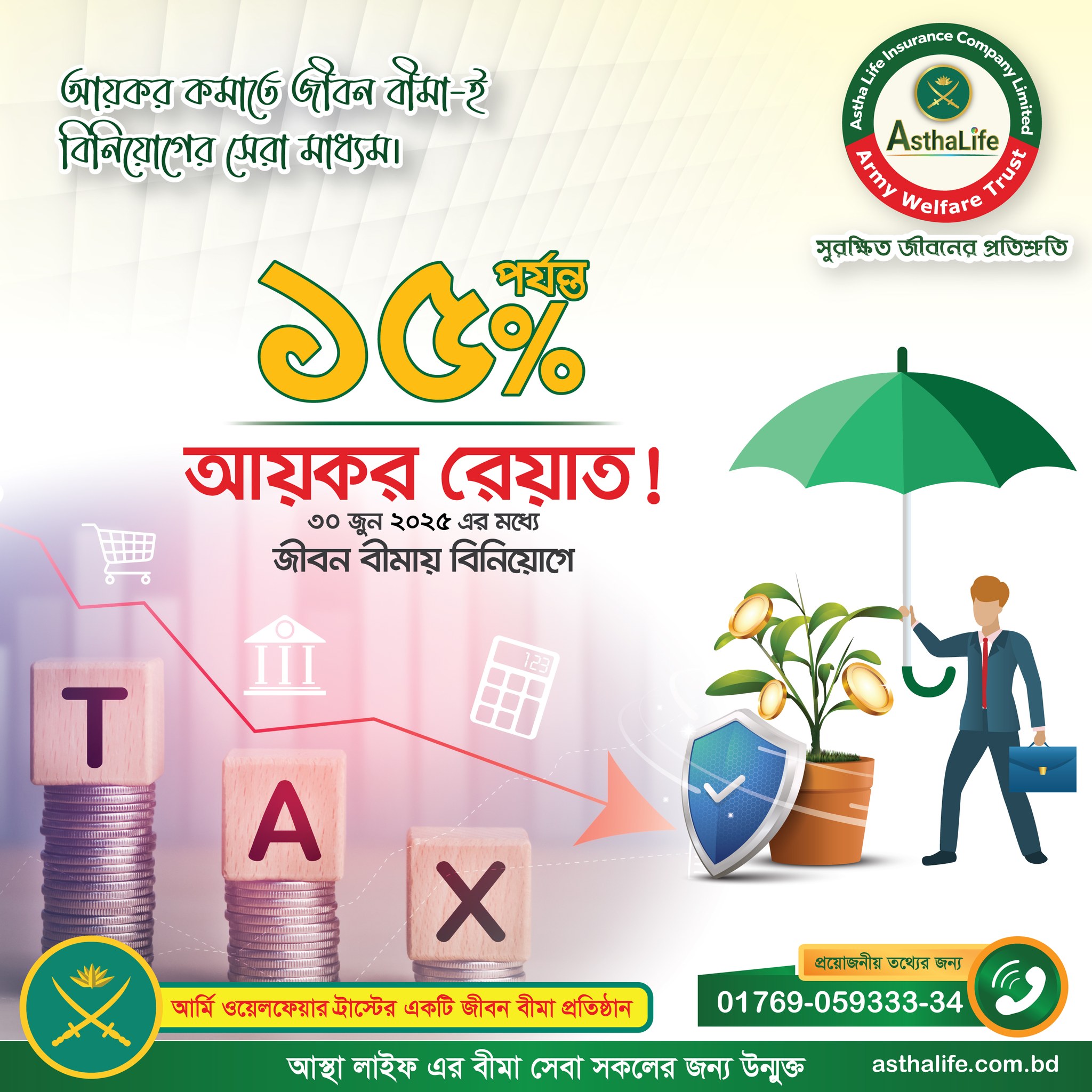

- Income tax rebate will be available on vested premium while filing personal income tax return.

Product Video